Over the past few days, thousands of taxpayers across India have received an unexpected message from the Income Tax Department. The SMS or email said their refund claim had been “identified under the risk management process” and that processing had been put on hold.

For many salaried taxpayers who were expecting routine refunds, the message was unsettling. It did not say what was wrong. It did not say what action was mandatory. And it did not say how long the refund might remain stuck. In the absence of clarity, confusion quickly spread.

People asked whether this meant scrutiny, penalties, or a formal notice. For a tax system that has spent years trying to project simplicity and trust, the reaction revealed a deeper unease.

WHAT TRIGGERED THE ALERTS?

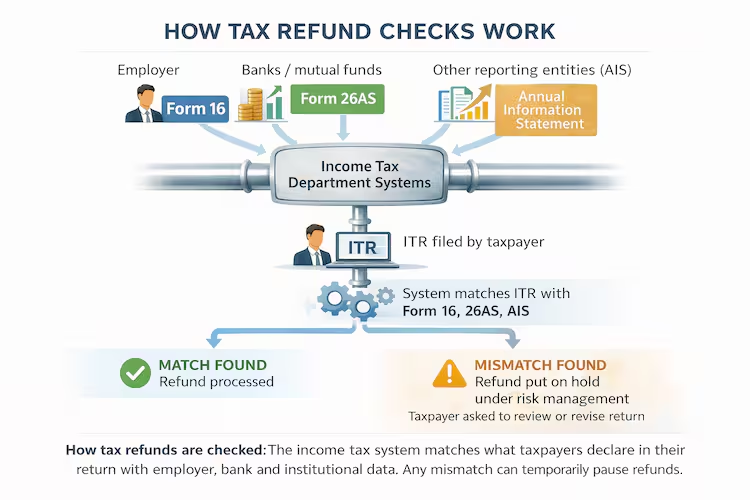

At the centre of the episode is the tax department’s growing reliance on automated checks. Over the last few years, the department has built systems that compare what taxpayers report in their returns with data it already has from employers, banks, mutual funds, and other reporting entities.

This data flows through Form 16, Form 26AS and the Annual Information Statement. When the system spots mismatches, refunds are paused so the return can be reviewed before money is released.